Is there any space left in the cloud communications market?

Recent announcements from some of the largest providers in this market have started to give some insight to how the cloud communications market is developing and how these providers are gaining significant scale in the market. The cloud communications industry has expanded rapidly over the past few years and growth has been enhanced by the pandemic as more businesses look to adopt cloud services and move away from on-premises deployments. The recent performance of Avaya (20% revenue drop and net loss of $1.4b) highlights the struggles that some of the legacy PBX manufacturers have faced by not successfully transforming their businesses to become cloud-first vendors.

One of the big questions that we get asked often is whether there are still opportunities for smaller or niche providers in the future or whether this will be all migrating to these larger provider. What we show throughout this article how much share do these providers have and how much of the global market there is left to migrate. We still see a huge opportunity for service providers to be successful in the market, either working with these providers listed or with their own solutions but scale and differentiation become more important as the market matures

Table of Contents

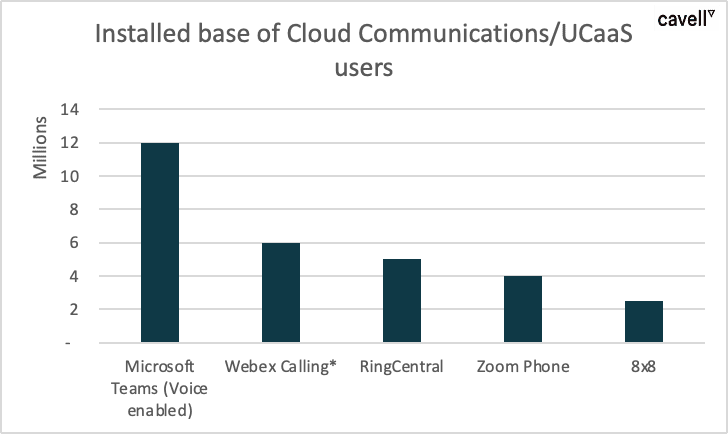

Five providers account for a global user base of 29.5m users

The graph below shows the providers who commonly are, as per our latest cloud comms reports, highlighted by service providers globally as their key competitive threat in the future and have been instrumental in much of the growth over the past few years.

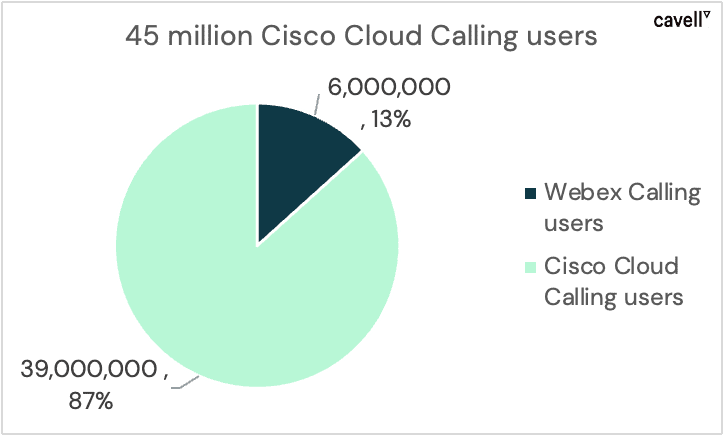

*Not including other Cisco Cloud Calling products (BroadWorks, HCS etc) – Cisco’s entire cloud calling base is over 45m users

Although the numbers attributed to each provider look like they control the whole market, the vast majority of the 29.5m users have been delivered by partners. These partners range from tier one operators down to small agents who are all taking advantage of the suite of services offered by these providers. There is an ongoing battle in the channel for dominance as all of these providers and the wide range of other vendors are trying to gain market share within the channel as well as in the end customer.

The battle for the service provider community has been heating up recently with many telcos looking at how they can build partnerships, examining their ongoing business models, and looking for class-leading solutions to take to market. With many geographic markets expanding rapidly, telcos are looking at how they can bring best in class services to market and differentiate from their competition.

Out of a total global available market of 467m users, 392m (82%) have not moved to a cloud comms solution yet

Cavell’s latest market research shows that there is a total available market of around 467m users, of which the majority have still not moved to a cloud communications solution. Cavell puts cloud comms (UCaaS) penetration currently at just over 18%, indicating that there is still a huge global market left to migrate to the cloud with over

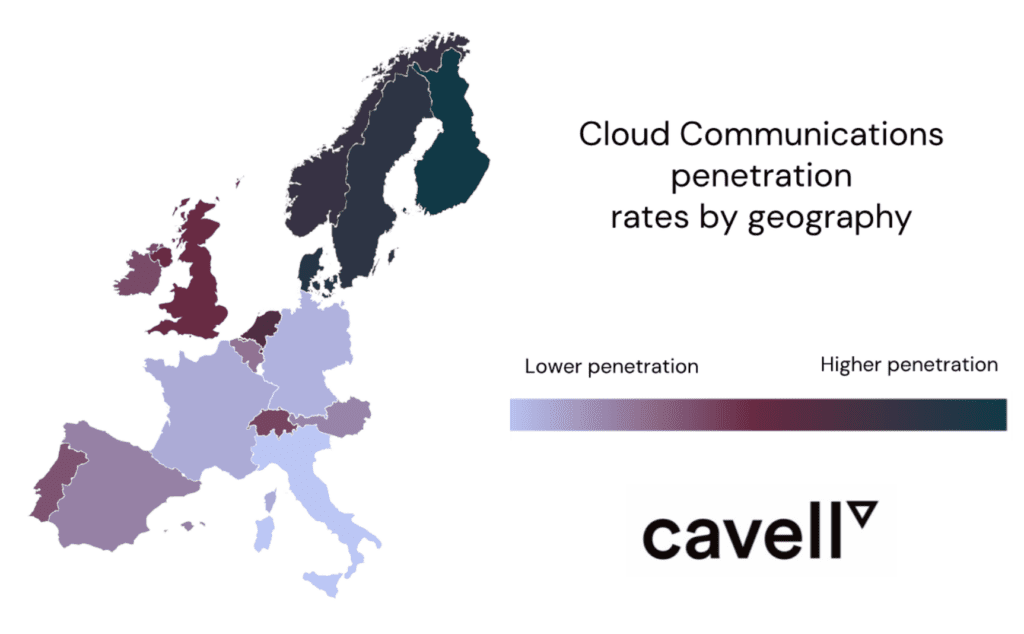

European Cloud Communications UCaaS penetration rates by geography

The penetration of cloud into the total available market changes by geography, with regions like the Nordics displaying a much higher penetration rate. Even markets such as Germany and France are still relatively underdeveloped with many providers looking to expand into these markets organically, via acquisition, or through building partner bases. The US market has the largest installed based of UCaaS users globally with over 39m users and by far the largest number of service providers operating in the market. When looking at some developing markets, we see a much bigger opportunity around mobile UCaaS and foresee a huge opportunity in coming years.

Our forecasts show that penetration rates will rapidly increase over the next five years as more business move their communications to the cloud, representing a huge opportunity not only for the providers listed, but also for the rest of the market.

How have some of the providers grown so fast?

One of the reasons why these providers have been able to get so much scale is that they have been able to execute in multiple markets, whereas many of the other providers we track only operate in one market. Each of the providers has been able to execute at scale and target multiple customer sizes in the market whilst bringing new services to complement their existing product base.

Microsoft Teams

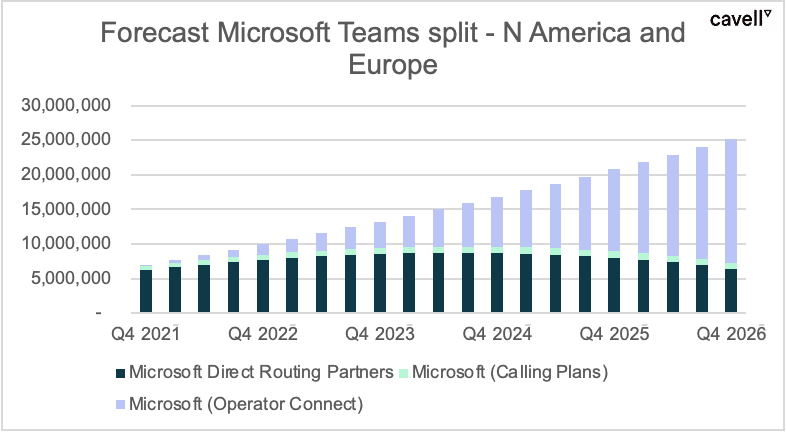

Microsoft Teams has been one of the growth engines since the pandemic hit, as many businesses adopted Teams to help enable remote working. From its most recent earning release Microsoft have now enabled over 12 million voice-enabled users on their platform. Cavell’s Microsoft analyst, Patrick Watson recently penned a blog post on how service providers are enabling voice within Teams which splits out the options available.

Webex Calling

Although Webex Calling only has 6 million users on its platform, this is not taking into account Cisco’s user base on their other cloud communications platforms such as BroadWorks and Cisco HCS. Overall, Cisco has over 45m cloud calling users with over 700 operators offering cloud calling using Cisco’s platforms. Webex Calling is gaining momentum through its partners as they look to leverage Cisco’s suite of communications services, and Cisco have made significant investments into the Webex suite in recent years.

RingCentral

RingCentral’s latest announcement of 5 million users has shown significant growth and its partnerships with the leading legacy PBX manufacturers and some large national telcos have helped to develop its market position in new markets globally. Their recent partnership with Vodafone is starting to be rolled out across multiple locations and expect to drive significant growth in the market with a mobile first proposition.

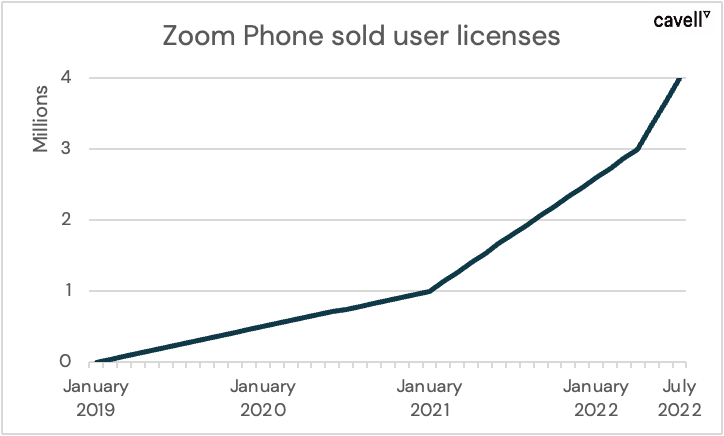

Zoom Phone

Although Zoom Phone was only launched in January 2019, its momentum following its incredible growth from the pandemic saw them sell 3 million users in the first three years since launching its service. Following on from this rapid start, Zoom sold over 1m licenses alone in the second quarter of 2022 which has resulted in a total sold base of over 4 million Zoom Phone users . This growth has not just come from converting existing Zoom customers to the Zoom Phone solution but also from bringing new customers to take advantage of its collaboration and phone solution.

8x8

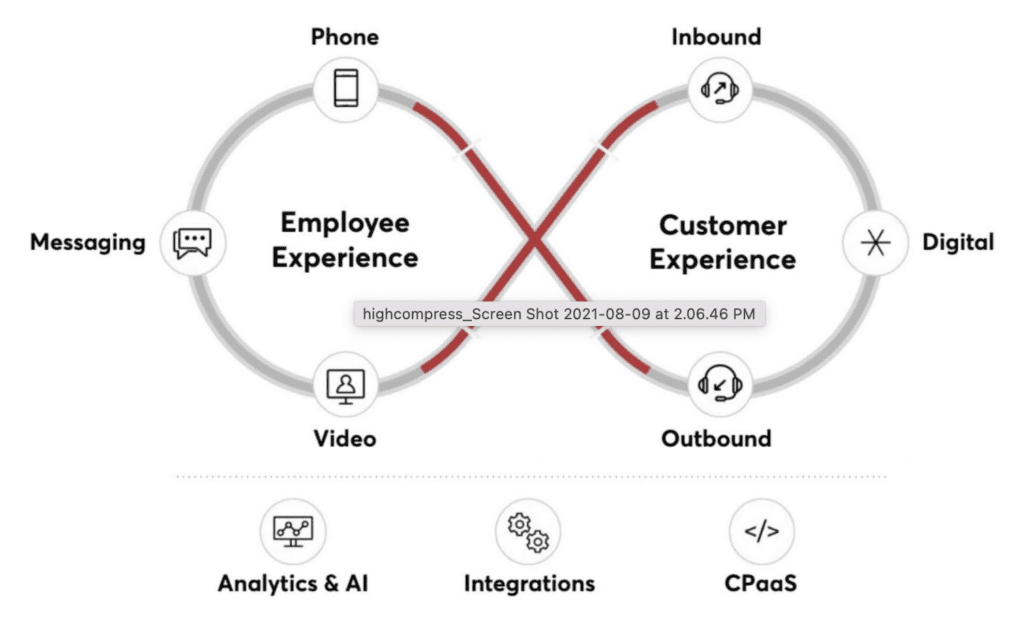

8×8 have grown significantly over the past few years to currently count over 2.5 million users. Their focus on XCaaS where they bought together contact center, voice, video, chat, and APIs into one platform has supported their growth and focus on contact center. Unlike the others that have grown organically, its acquisition of Fuze last year added to this user base, giving 8×8 a range of large enterprise customers and a footprint into new geographic markets.

What about the rest of the market?

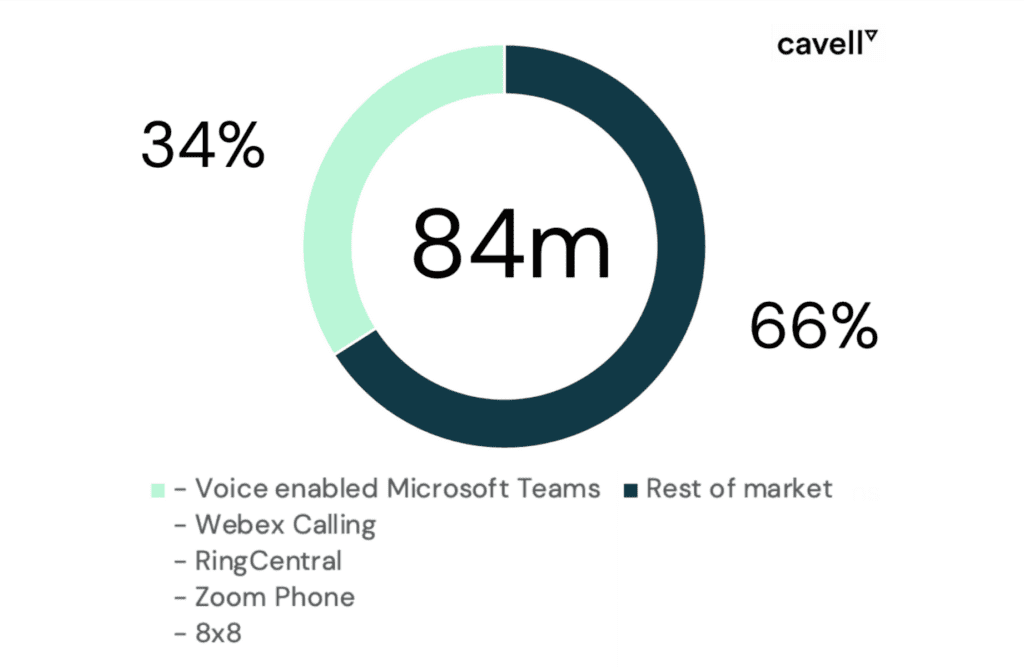

Outside of the five providers listed, there are still a considerable number of providers with scale in the market. Overall, the providers listed have a combined cloud comms market share of 34% within a total global user base of 84m cloud comms users, highlighting that the rest of the market still commands a significant share and new user growth isn’t just going all to the these providers.

When looking at individual countries, the competitive landscape changes dramatically, with large telcos typically dominating the market share in the country, with several larger national competitors and many smaller local providers serving the SMB market. Each geographic market is unique in terms of competitors operating, penetration rates, buying behaviour, regulation, maturity of solutions sold, and route to market. The providers listed above have had varied success in markets outside of the US with some markets still very much focused on local competition.

Providers in combined cloud comms market share of 34% of 84 million total global cloud comms user base

There are also several regional challengers emerging who are growing via acquisition and organically to gain significant user bases across the continent and to challenge the status quo in many markets. Providers like Dstny, with over 2.4 million users, and Enreach, with 2.3m users, are now present in multiple markets and growing quickly. Others like Gamma, NFON, and Wildix also have growing cloud comms user bases in different markets across Europe and command significant market presence in their home markets, far more than the other providers listed above. There are over 800 providers in W. Europe and N. America alone managing their own cloud communications platform, the market is much more fragmented than many providers think.

How can you take advantage of this?

It’s easy to look at the numbers posted by the larger providers and think that the market opportunity has disappear and that they will inevitably win in the future.

In the 16 markets that Cavell covers in-depth in our market reports, no provider has a market share of more than 50%, and in most markets the market leader has under 25% market share of the cloud communications market. There are still huge opportunities in all the major geographic markets and understanding those markets and the competition is key to being successful in them, as well as understanding how customers’ demands are changing.

Those that are successful are looking at ways to grow rapidly, be that through acquisition or driving innovation to support differentiation. With the number of providers operating in the market, there are ample opportunities to invest and build inorganically and there are still new companies emerging disrupting the status quo with new GTM strategies and executing strongly.

Although we are forecasting significant growth in the market, all the telecoms providers that we speak to are seeing their margins squeezed, inflationary pressure growing, competition changing, and the challenge of how to differentiate increase. This is a growth time in the industry and if you are worried about how you can take advantage of this, maybe you need some support.

How can we help?

With over 800 service providers in our database feeding into our market reports across Western Europe and N. America, our data is used by all the major telecoms providers and vendors and many smaller providers to help them understand the markets they operate in, now and in the future.

Our Cloud Comms market reports help organisations understand the dynamics of each geography, what the current landscape looks like and where the future opportunity lies. We also provide forecasts by market on Microsoft Teams voice enabled users split by voice enablement as well.

Our Telecoms Buyers Reports (2022 edition released shortly) are surveys of the telecom’s buyer within companies, from SMEs to large enterprise, looking at what they buy now and, in the future, who they want to buy from, and why they buy from them.

Share this post

Dominic Black

Dominic is Director of Research Services at Cavell Group and is responsible for Cavell’s research output, which is focused on the cloud communications market, both from an enterprise, channel, service provider and vendor perspective.