What the Microsoft and Metaswitch Deal Means for the Communications Industry

Instead of taking a summer holiday in 2020, Microsoft decided to shock the industry by acquiring Metaswitch.

Some people thought it was inevitable.

Of course, Microsoft was going to acquire a key global communications player.

How else was it going to accelerate its cloud communications strategy?

It didn’t appear that internal development was high on their priority list.

The signs were there, I just didn’t join the dots.

Table of Contents

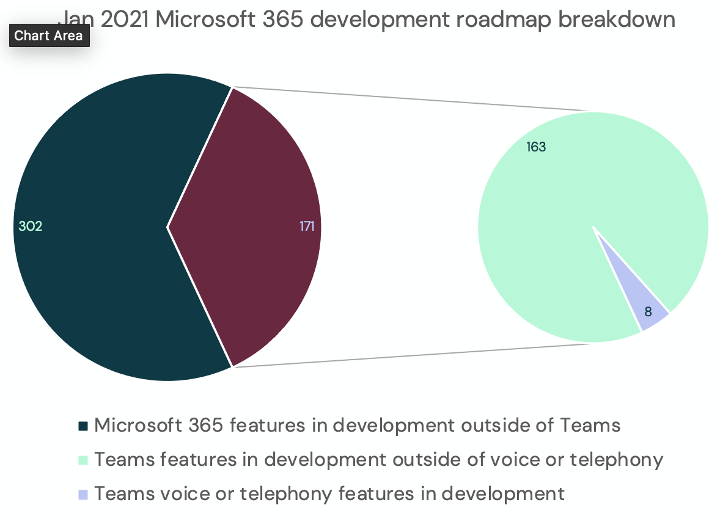

The publicly available Microsoft Teams development roadmap shows the lack features and functions in development that relate to Microsoft Phone System or telephony capability within Teams.

Maybe this lack of development signalled that Microsoft’s strategy lay outside of its own internal capabilities. It seems obvious now that an acquisition was the most likely tactic.

It turns out, however, that the above was a rudimentary assessment.

The deal for Metaswitch appears to be much more nuanced than I initially thought.

So, why did Microsoft acquire Metaswitch?

The deal for Metaswitch appears to be much more nuanced than it initially appeared.

Firstly, phone system functionality, UCaaS, and telephony capabilities were apparently not key factors behind Microsoft’s purchase.

Metaswitch’s technical knowledge and intellectual property in the realms of networking and connectivity seem to have been the been the priority for Microsoft.

The deal was announced by Yousef Khalidi, Corporate Vice President for Azure Networking, at Microsoft, providing further indication about which division within Microsoft was driving the deal:

“The convergence of cloud and communication networks presents a unique opportunity for Microsoft to serve operators globally via continued investment in Azure.”

Looking to expand capabilities within Azure, enabling it to better compete with AWS is apparently a key strategic target for Microsoft.

Metaswitch has always been focused on helping its partners compete with increasing threats from over-the-top providers by equipping them the cloud-based tools that better enable service providers to fend off external competitors.

Metaswitch CEO, Martin Lund’s, statement also focused more on connectivity and networking:

“We’ll be ideally placed to aid those operators keen to transition to cloud native deployments, to 5G networks and to the era of compelling applications that are served from the core and edge of new network architectures.”

Network function virtualisation (NFV) has been a focus for several years and Metaswitch’s expertise in that area allowed them to attract a number of larger service providers and telcos.

It is this forward thinking and expertise in the communications space that Microsoft are looking to leverage.

Matthew Townend, Executive Director at Cavell Group, provided some additional insight into the rationale behind the deal:

“This deal is predicated around Microsoft increasing Azure capabilities, and Microsoft have not just acquired technology but very strong telco skills experience and personnel. Edge computing and NFV are becoming more important and Microsoft are gearing up for a key role in telco cloud.”

How much did Microsoft pay for Metaswitch?

Despite not disclosing the full financial details, a filing submitted by Microsoft to the US Securities and Exchange Commission showed that Microsoft paid $270,255,106 in stock as part of the financial package. The stock however might only represent a proportion of the overall package.

It’s unclear if there was any cash involved on top of the stock value, and Microsoft has not revealed any further details since the acquisition closed back on 14th July, 2020.

When the deal was announced, Microsoft did not publicise the full financial details.

There are number of reasons behind non-disclosure.

Firstly, they aren’t legally required. Privately-held companies, like Metaswitch, are not required to disclose any information.

Public companies, like Microsoft, may have different disclosure rules although it varies regionally the US.

Deal details are generally not disclosed, often in an attempt to protect private data from use by competitors.

There could be other reasons.

Metaswitch might have included the disclosure details as part of the acquisition, or one of the parties might not want to reveal the overall price. However, all of this is speculation.

One thing we can be sure of is that Microsoft is serious about connectivity and networking. Paying at least $270M for Metaswitch followed the $1B+ purchase of Affirmed Networks.

Affirmed Networks specialised in 5G software and also had other capabilities similar to Metaswitch. It also offered NFV, which is taking the operations that networks need to run and making them more digital/intelligent.

The value of deal was believed to be around $1.35B and with Metaswitch on top Microsoft demonstrated its intent in cloud networking world with at least $1.5B in purchases in the first half of 2020.

Its strategy appears to be to compete directly with Google and Amazon for the cloud networking market.

Why is cloud networking so important?

Let’s focus on the current networking landscape and where this acquisition, combined with the recent purchase of Affirmed Networks, places Microsoft in the heart of the telecoms landscape.

To broaden the picture, Microsoft has been at the heart of the business computing world for years, but there has always been a gap at the edge where Microsoft ceded control of the ecosystem to the network players.

Now there is an emphasis on visibility and network control in the functioning of applications.

We are seeing that with SD-WAN, SASE, and other trends, how applications interact with networks and how networks are controlled and managed is becoming more and more relevant.

By acquiring both companies, Microsoft has opened window to access the telecoms space in a direct and innovative way.

It’s important to understand that networking landscapes are currently in flux.

There is the rise of 5G, and questions about what that extra bandwidth will be used for by businesses.

There are also capacity problems and SD-WAN is proving more popular in attempt to solve them.

Finally, there are security challenges and mobility challenges that kickstarted the whole Secure Access Service Edge (SASE) discussion.

In the next, 3-5 years, we will see a rise in Edge computing where much of the processing power currently managed by clouds is moved more locally, we will see 5G secure its place in homes and businesses, and automation will become an even more important part than it already is.

Microsoft must be looking at this as an opportunity they have never had before to be at the forefront of telecoms and gain a new market share.

This brings us back to the core reason for these acquisitions – people.

If you review Metaswitch’s key facts, you will see that of the Metaswitch’s 840 employees, 329 of them are involved in R&D. That is over 20% of the organisation.

In acquiring Metaswitch and Affirmed, Microsoft have bought themselves a large amount of network expertise, and R&D capability to build the solution for “What’s Next in Networking”.

Microsoft Teams and Metaswitch

There was a lot of speculation about what the deal might mean for Microsoft Teams.

With even more speculation relating to what this might mean for the huge numbers of service providers and telcos that have rushed to integrate with the world’s most popular collaboration application.

Teams was almost conspicuous by its absence in the Microsoft blog that broke the news.

Focusing entirely on Azure, networking, and connectivity the absence of any mention of Teams only seemed to fuel external speculation.

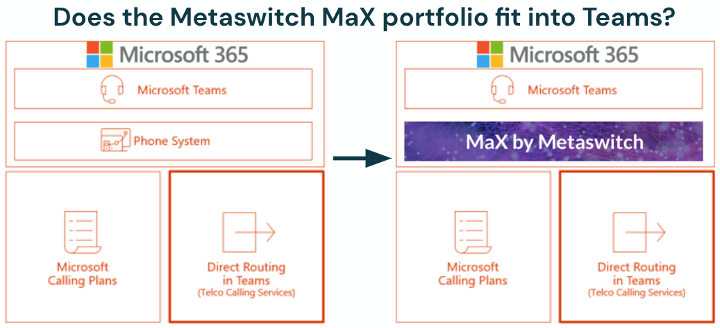

Will Microsoft look to leverage Metaswitch’s existing technology to accelerate the development of its phone system and telephony capability within Teams?

It would seem strange for this not to have been some sort of factor in the background of the overall deal. It does appear though that this was well down the list of priorities.

Even if the wild speculation was correct and Microsoft did look to accelerate development of Teams communications capabilities using assets from Metaswitch, it might not be something that would impact the product or partners in the short term.

Portfolio integrations are never easy or quick.

Microsoft acquired Skype in 2011 and Skype for Business didn’t become available as an enterprise ready product until 2015.

Over the longer term, the picture is much less clear.

With its global popularity, presence within Microsoft 365 subscriptions, and Microsoft’s aggressive marketing behind it, Teams, has already captured a huge market.

If it could then incorporate a class leading cloud PBX solution, it would be a compelling proposition indeed.

This is one for the whole industry to keep an eye on and many providers will be re-evaluating their Microsoft product and partner strategies over the coming months.

For more detail and background on Microsoft’s acquisition of Metaswitch, watch our free webinar: The Impact of Microsoft’s Acquisition of Metaswitch.

Share this post

Patrick Watson

Patrick Watson is Cavell’s Head of Research. His main area of expertise is the cloud communications industry, with a particular focus on the collaboration sector. For over ten years, Patrick has been a noteworthy member in the technology community, with a degree specialising in broadcast journalism and data analytics.