Should Unified Comms Vendors Be Scared of Video Conferencing?

Technology markets evolve at a rapid pace. Fluctuation in enterprise demand requires unified comms vendors to adapt their portfolios to remain relevant. One area that is causing increasing disruption within the unified communications space is the surging demand and uptake of video conferencing services.

Video communication was often seen as an optional extra. Conference calls took place using audio only with participants reluctant to engage in a visual exchange, even if they had the option to.

Throughout 2020 and 2021, video has come into its own as the default communication method.

‘Video first’ is now a phrase that has garnered true relevance.

Many fear that video conferencing specialists might attract customers who are looking to embrace emerging communications. The use of voice services may also be impacted by increasing enterprise adoption of video conferencing.

Unified communication vendors globally are now looking at video conferencing specialists as their key competitors over the coming years. This article will explore some of the macro trends behind this increased competition and try to confirm if the unified communications industry should fear video conferencing.

Table of Contents

Video conferencing growth stats

The demand for video conferencing services globally has increased exponentially over recent years. Various macro factors including the rising adoption of remote working and the increasing geographic spread of businesses have amplified enterprise demand for video services with businesses aiming to keep workforces connected and productive.

Grand View Research valued the global video conferencing market at $4.21 billion in 2021. A forecast compound annual growth rate of 11.4% to 2028 would place the market value at $9.95 billion.

Cavell Group’s own research has also revealed a huge increase in demand for video conferencing from the perspective of technology providers. In its 2020 COVID-19 study Cavell Group heard that 72% of service providers globally reported over 50% increase in the usage of pre-existing video conferencing solutions.

This increased usage was caused by surging enterprise demand. Enterprise adoption of video communication grew more rapidly than any other area.

Only 31% of enterprises were using video communication in 2019 – this had grown to 51% in 2020.

Organisations with 250 seats or more report the highest increase in video usage, with 86% uptake in 2020 rising to 92% in 2021.

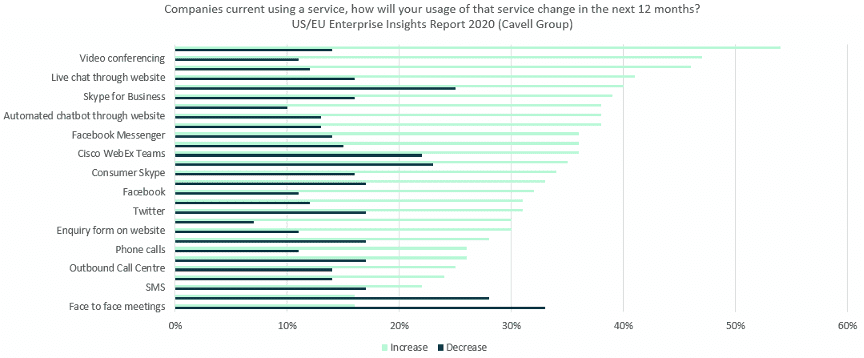

In addition to the elevated levels of current uptake, data also shows that enterprises are planning to utilise more video throughout 2021.

In Cavell Group’s Enterprise Insight study 47% of the 2000 businesses surveyed said that they were planning to use more video conferencing products over the next 12 months from August 2020 onward.

The boom in demand for video conferencing services can also be seen clearly by data revealed by the world’s leading vendors.

Zoom, which saw its awareness and usage explode during the pandemic, clearly demonstrates the increased demand for video. Although Zoom offers both consumer and business focused video conferencing solutions the increase in uptake it witnessed was still remarkable.

Zoom had around 10 million meeting participants in 2019 which grew to 200 million in March 2020 and then nearly doubled to 350 million by December of that year.

Although much of this growth can be attributed to consumer uptake, its business customers also multiplied over the same period, growing from around 80,000 to more than 470,000.

Business-focused applications also reflected the boom in demand. Microsoft Teams, a collaboration solution which includes video conferencing, revealed that twice as many users turned on video after the onset of the pandemic when compared with pre-pandemic usage.

Video calls within the application increased by more than 1000% in March 2020 and Teams set a record of 2.7 billion video meeting minutes taking place in just one day.

Smaller video providers also witnessed similar growth in platform usage with Lifesize, Vidyo, and BlueJeans all reporting multiplied service provision.

The extraordinary growth in video conferencing – in terms of market value, demand, and usage – clearly demonstrates the need for an increased focus from UC providers.

How does the COVID-19 pandemic impact the video conferencing market growth?

The COVID-19 global crisis has pushed video communication to the top of our news agendas.

In Cavell Group’s ‘COVID-19 Impact Study, 47% of service providers reported a 50-100% increase in the use of video conferencing services.

There were many factors at play long before the virus took its toll on global workplaces. Although video conferencing technology has been around for decades, it was traditionally confined – within business environments – to large enterprises who could afford high end video enabled meeting and conference spaces.

Within the last decade, the dramatic reductions in video endpoint pricing have seen video technology become widely available to the masses.

Although the COVID-19 crisis caused mass migration to work from home scenarios, this trend was already accelerating in businesses prior to this.

Cavell Group’s Enterprise Insight Report 2020 showed that many businesses were already offering remote working as an option to their employees. This trend was merely accelerated by COVID-19.

And even when the crisis subsides, it appears the tide has already turned, and many will never return to the office for the standard 9 to 5.

So why have these changes in working habits helped to make video so popular?

The answer seems simple enough. If you are not seeing your colleagues in the office, then you need to see them virtually.

Video communication offers a range of benefits that audio-only communication cannot match.

Non-verbal cues like body language have been key indicators throughout human development.

Recognising emotional responses and engagement levels are critical to the success of collaboratives under takings.

It is these benefits that have seen video conferencing become so popular in the background of a global pandemic.

Other factors impacting the video conferencing market increase

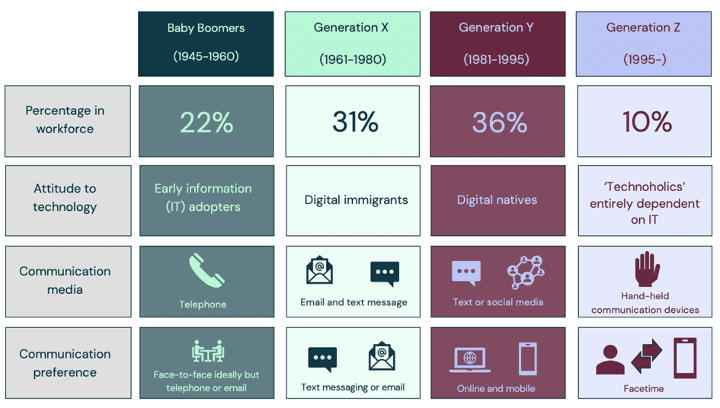

It’s not only increasing levels of remote working that underpin the rise of video. Workforce generational changes are also impacting its popularity in the enterprise workforce.

Younger generations, who are digitally native, are much more inclined to utilise video communication technologies.

Research shows that by 2025 Generation Z will comprise 36% of the workforce, further driving demand for video communication.

The level of older generations within the workforce who are, both anecdotally and in practicality, less likely to engage with newer technology like video is falling.

These changes have forced the enterprise to incorporate technologies that match the needs of their increasingly younger workforces, with video being a key constituent.

Finally, we must look at our consumer technology habits. Consumer trends inevitably enter the workplace and communication is the most viable area for that perforation.

From 2015 to 2018, live video chat usage with businesses and brands grew by 233%. Improvements in software like Facetime, Skype, and social media all contributed to this increase in video usage during the three-year span.

The rising popularity of face-to-face calls in consumer settings has further forced the hand of businesses to ensure employees do not default to consumer apps, adding to the problem of shadow IT.

Enterprises now need to provide the means for employees to connect visually with colleagues and third parties.

Where do UC vendors have the upper hand?

Unified communications vendors may not have historical expertise in the realm of video conferencing. But they do possess other assets which mean that they can negate the disruption of video natives like Zoom.

UC vendors have an established history within the communications space. With traditional expertise voice-centric communications, UC vendors already have experience when incorporating new technologies, and the addition of video shouldn’t be any different.

Vendors within the UC space have already expanded their provision of communications tools beyond just voice.

Services like email, messaging, and audio conferencing are already included within many of their portfolios. Vendors can utilise this expertise within the communications space to add provision of video and ensure that they can meet the demand of businesses looking for visual communication tools.

There is now a heighted focus on the security and compliance capabilities of video conferencing services with several high-profile vendors experiencing public security issues.

UC providers and vendors, with their traditional strength and focus on business-to-business markets may have an upper hand in the compliance and security of their systems. Enterprises have highlighted security improvements as the number one priority for collaboration platforms.

Global circumstances in 2020/2021 also heighted the focus on security provision as enterprises look to ensure that remote communications are as secure as possible. These factors make security a key criterion for providers to consider when evaluating video platform partners and products.

Ensuring that any platform used has security at the forefront of its design is vital as it will be a key purchasing driver for enterprises businesses.

Another key asset for UC vendors and service providers are their well-established customer bases. Many of the emerging video conferencing providers are looking to capture market share with freemium solution offers.

Existing UC vendors have already established their own customers and should look to leverage their position as trusted advisors. Providers do need to ensure that they avoid disruption from intrusive video vendors by offering innovative video services that meet or exceed competitors’ offerings.

Should Unified Comms vendors be scared of video conferencing?

If video does, or already has, become the default communication method, what does this mean for the UC industry?

UC vendors and service providers may not have fully considered strategic usage of video platforms. There are multiple options available to them – build, buy, wholesale – each with their own pros and cons.

One thing is for sure, though: the modern enterprise, and the modern customer, will be keenly interested in provision of video services. Video is going to be a key pillar of enterprise communication strategies.

To capitalise on this opportunity, vendors and service providers must have a suitable enterprise ready video solution available in their portfolio.

Enterprises will be looking for platforms which offer all the benefits that video brings, alongside security, reliability, and quality.

Ensuring the appropriate options are available for customers will be key for the next decades most successful communications technology companies.

To make sure video conferencing platforms don’t steal your UC business, book a call with the Cavell team for a free portfolio planning call.

Share this post

Patrick Watson

Patrick Watson is Cavell’s Head of Research. His main area of expertise is the cloud communications industry, with a particular focus on the collaboration sector. For over ten years, Patrick has been a noteworthy member in the technology community, with a degree specialising in broadcast journalism and data analytics.